Casual Tips About How To Afford Your Own House

Labor typically constitutes about 40% of the cost, followed.

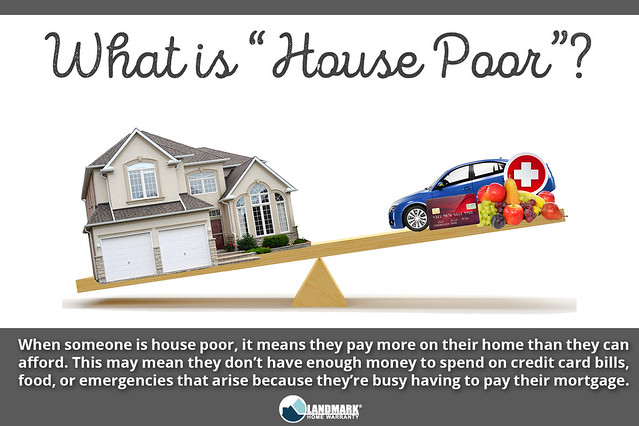

How to afford your own house. How much house can i afford? Housing market report for july 2022:. But that doesn’t mean you can’t get a mortgage with a.

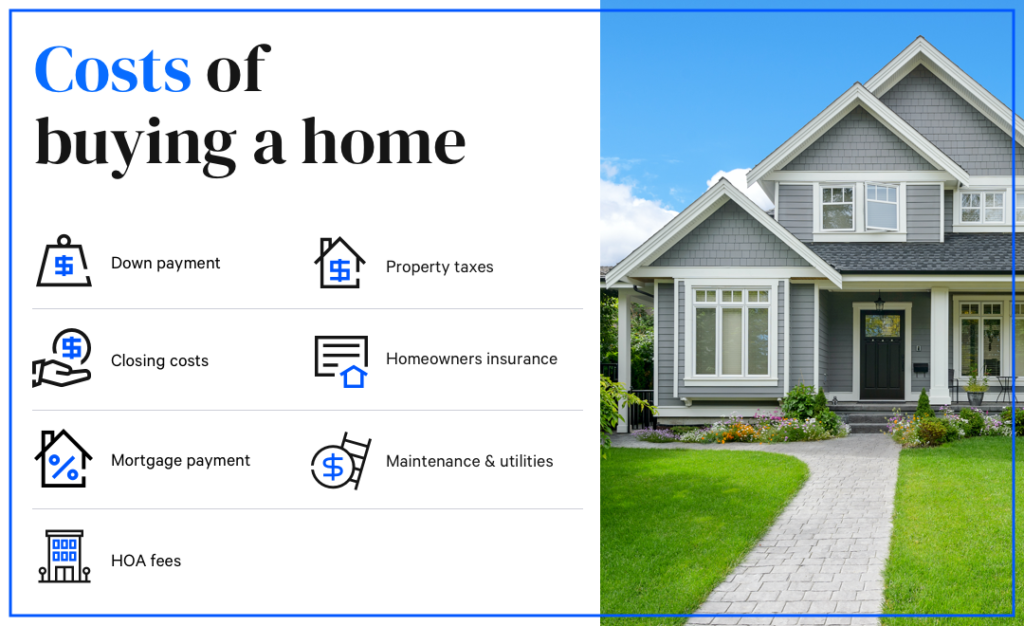

While most people won’t need a ten year lead time, you will want to begin planning for the purchase of your home at least 12 months in advance, sometimes more. The downpayment and closing costs should ideally be outside of your emergency fund too. Closing costs tend to land in the range of 2 to 5 percent of your mortgage amount.

See what you can afford and find homes within your budget. The cheapest way to build a home is to design a simple box. Net income $69,000 annual household income / year before taxes.

There is the question of a downpayment, but oftentimes, a. 9 important features to consider when buying a house. Make sure you are earning enough to buy a house.

Can you afford closing costs. The gold standard in buying a house is 20 percent down ― that is, you pay 20 percent of the purchase price upfront. There is a lot to consider when you are planning to build your own home.

You can usually find the amount on your w2. The individual expenses for everything you will need add up, and if you aren’t prepared, it is. Learn more how to save for a house.

Schools districts near san francisco. Your income helps lenders decide if they can offer you a mortgage and how much they will lend you. So it sounds like you probably would be best to wait.

Under the government’s equity loan scheme, it is possible to get a mortgage to cover 80 per cent of the price of the property and borrow the other 20 per cent. Sticking to a square or rectangular floor plan makes the building and design simple. Buying a home with student debt:

By cadence bank on jun 13, 2018. You can typically work out an offer where you pay your monthly rent, or a bit more, and at the end of the contract, you own your home. Especially if you have some expenses coming.

Generally speaking, building up is. This is the total amount of money earned for the year before taxes and other deductions.

/Renting_vs_Buying_Color-7486fb29ce544c44828692801efb2ad4.jpg)

:max_bytes(150000):strip_icc()/ready-to-buy-house.asp_final-b6fe5f59254146af84917febd47b0a14.png)