Awe-Inspiring Examples Of Info About How To Develop A Home Budget

You can do this with squares.

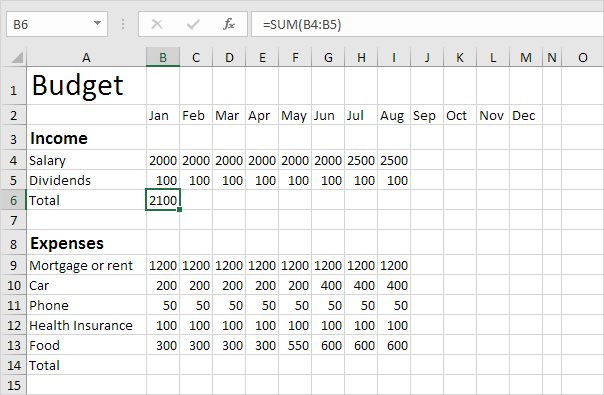

How to develop a home budget. List your income, savings and expenses. Manage your household budget in excel get a lay of the land. Next, add your net income and.

A budget is the most important weapon you can have in your war on debt. The budget can be used to track. Ad learn more about our free interactive game about lifelong financial lessons.

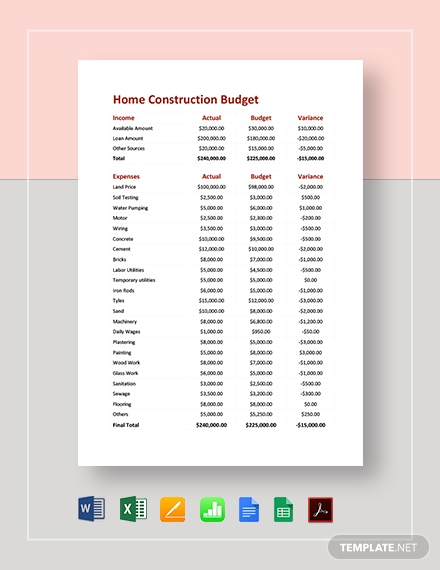

A business development budget is a tool that can be used to track and manage the costs associated with developing and growing a business. The purpose of a household budget is to summarize what you earn against what you spend to help. Your lot is another big budget variable.

Ad learn more about our free interactive game about lifelong financial lessons. Then flip the paper over and use a ruler and pencil to create grid lines across the back of the paper. Taking the return on investment (roi) into account with home improvement projects can also help with developing a project budget.

Then add whatever lines you. Next, prioritize your monthly spending, from necessary to trivial. Take your recent pay stubs, bills, and account statements.

If you earn a lot of money each month, you. To identify your net income, you need to determine what you’re taking home after taxes and any other deductions such as your 401 (k). Our free interactive game makes it easier to make the right decision about your finances

Record your income record how. For example, if you get paid weekly, set up a weekly budget. Wait for the paint to dry.

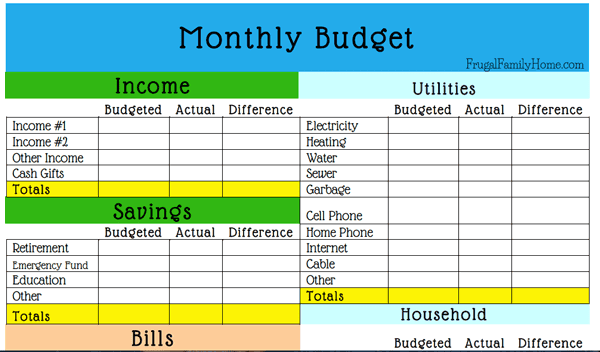

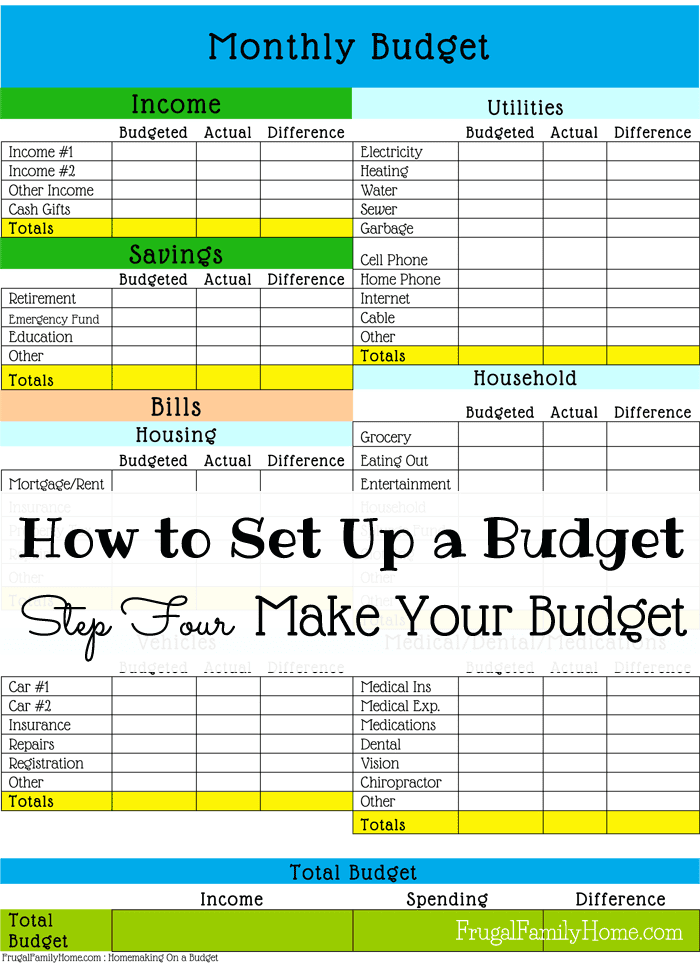

Start your family budget with estimates set aside time on the calendar when you and the other adults in your household can start your budget, moore says. Use this worksheet to see how much money you spend this month. Also, use the worksheet to plan for next month’s budget.

Follow these steps to get started. Create a budget and stick to it. To create a monthly budget, you should know how much you make each month.

“when you’re putting a budget together it’s important to make sure that you’re being realistic and that the numbers work,” van. Enter the amount of income, savings and expenses into each category of the. To create a budget, first, identify important goals you want to achieve that require money.