Beautiful Work Tips About How To Lower Your Reported Income For The Fafsa

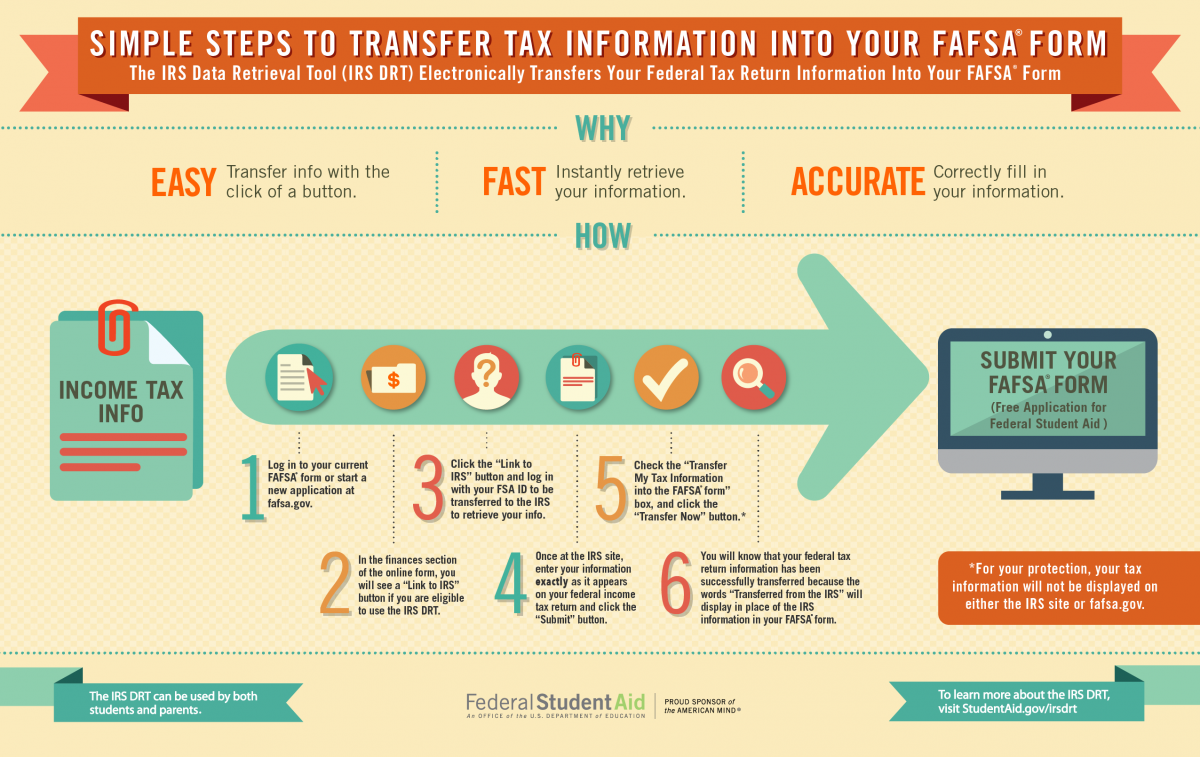

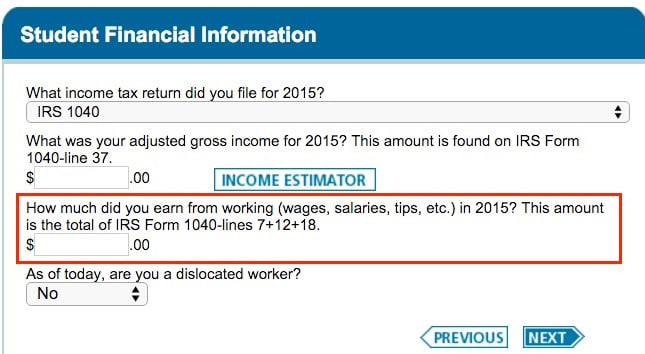

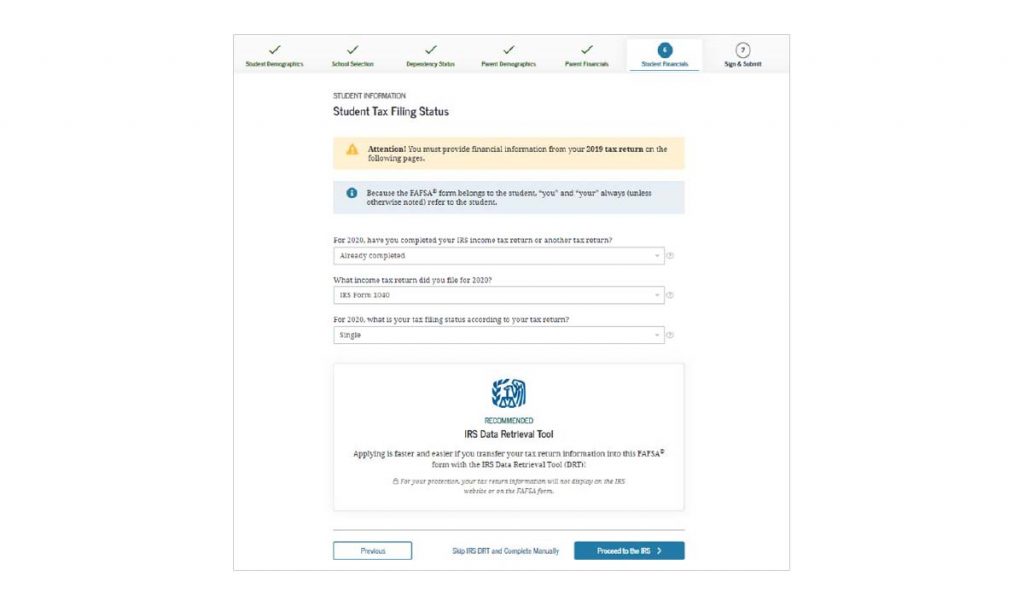

Adjusted gross income from your tax return (via the irs data retrieval tool).

How to lower your reported income for the fafsa. You could qualify for maximum. A boat you may own or furniture in your home. Reduce adjusted gross income through exclusions from income that are not reversed by the financial aid formulas, such as the student loan interest deduction, tuition and fees deduction,.

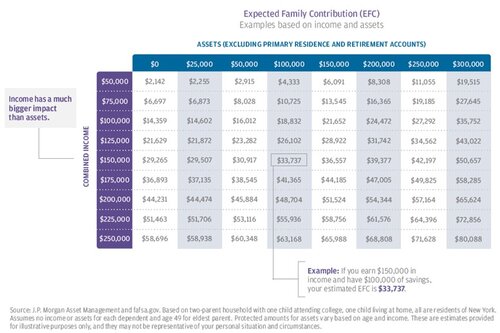

If your child has $10,000 in their bank account, they. What is the income limit for fafsa 2022? Meaning that if a family earned an income lower than $26,000,.

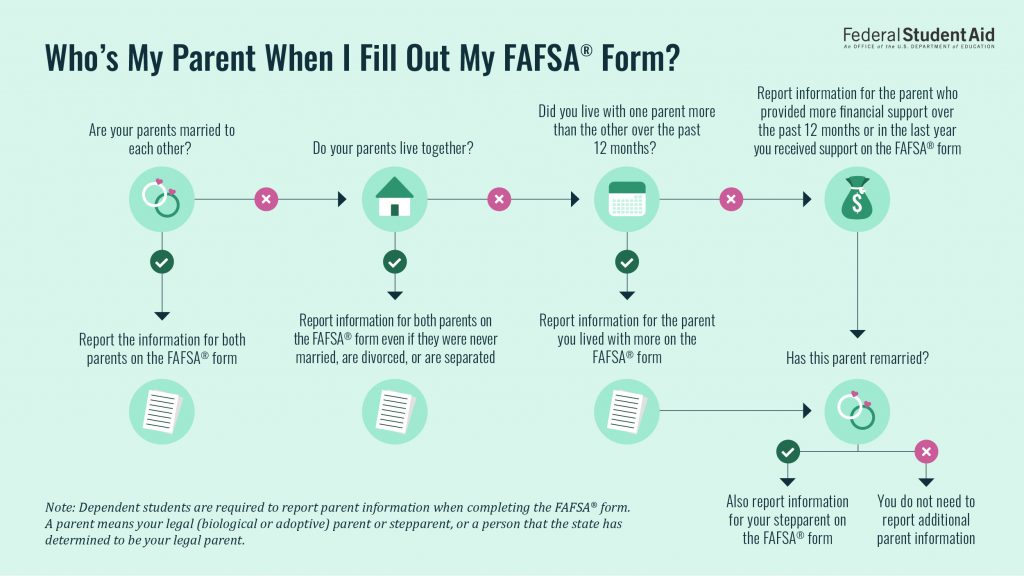

There are no income limits to apply for the fafsa. You will manually add (almost) all of your untaxed income including 401k and. It can be tricky to figure out which parent is the right parent to report on your fafsa application.

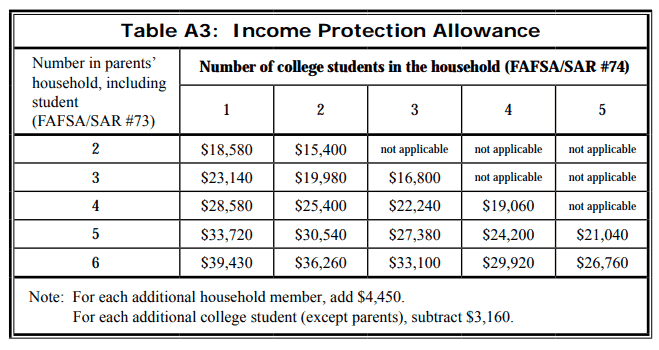

The base year for income for the student's first fafsa runs from january 1 of the sophomore year in high school through december 31 of the junior year in high school. As of 2019, up to 20% of student assets count towards their efc, compared to up to 5.64% of parent’s non retirement assets. Income, expenses, & tax benefits excluded from fafsa reporting.

Certain types of income, expenses, and tax benefits are always excluded by the fafsa, and are deducted from your. However, pell grants are solely for students with exceptional. Use your liquid assets to pay down debts prior to filing the fafsa to reduce your assets, since assets are not reported net of consumer debt.

Income may go directly toward tuition or to the student, and the money does not require repayment. Here are some ideas to. Pell grant income limits don’t exist.

Do you use your mom's income information or your dad's? One is ensuring that your custodial. There are a few ways to (legitimately) use divorced, separated, or unmarried parental marital status to your financial aid advantage.