Inspirating Info About How To Reduce Tax Payment

How to reduce your tax legally and ethically.

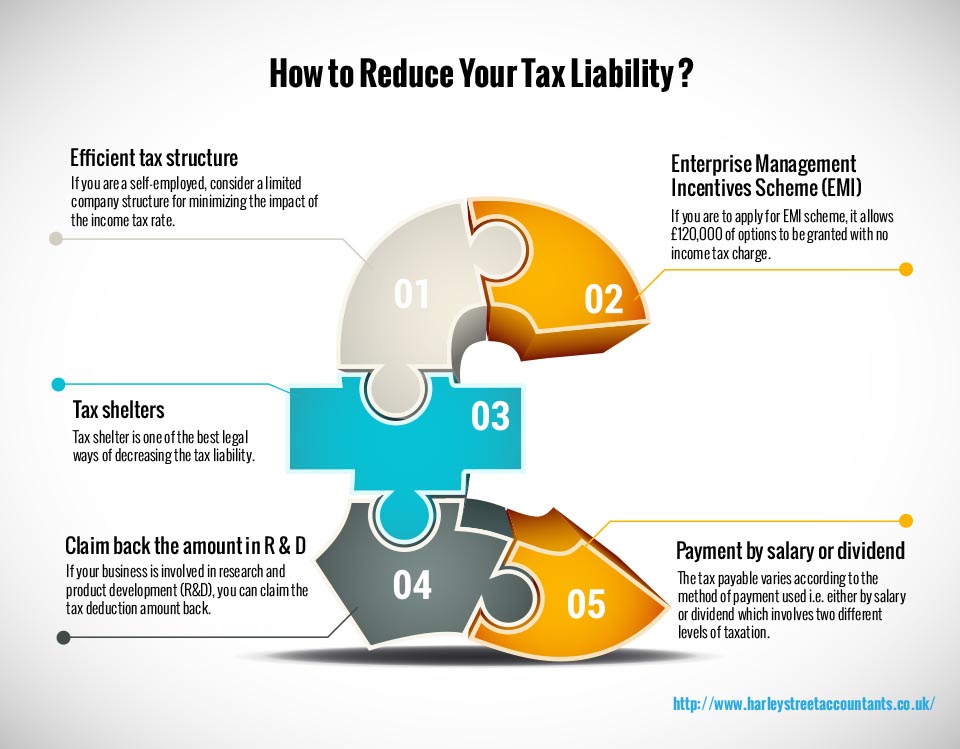

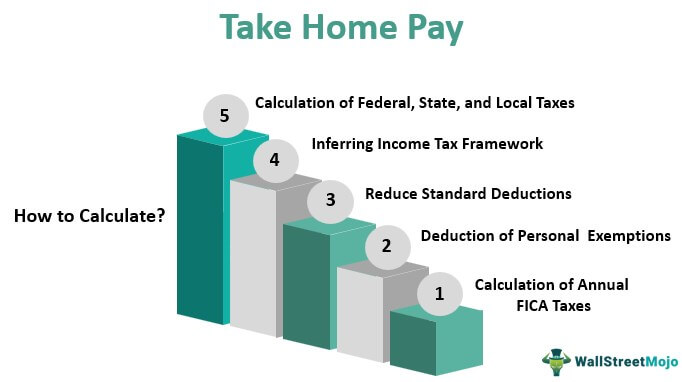

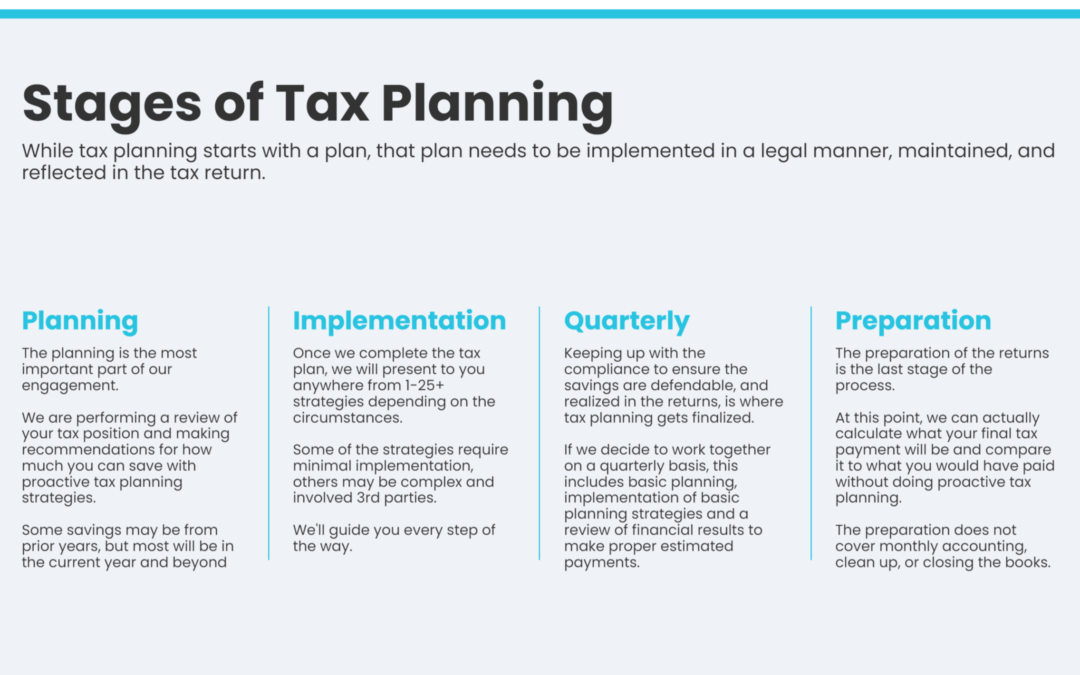

How to reduce tax payment. To help you get there, here are some things you can do to cut your tax bills and save some money in return. Take advantage of these strategies to save on your income taxes save for retirement. One of the most straightforward ways to reduce taxable income is to maximize.

It helps remind you about receipts you should find and deductions you can claim to reduce tax and boost your refund. Income tax is based on your taxable income, not your total income. Legitimate ways to save income tax.

Ppf (public provident fund) elss funds. Just because your property has lost 20% or 30% of its value in the. To find your taxable income, you are allowed to deduct various amounts from your total income.

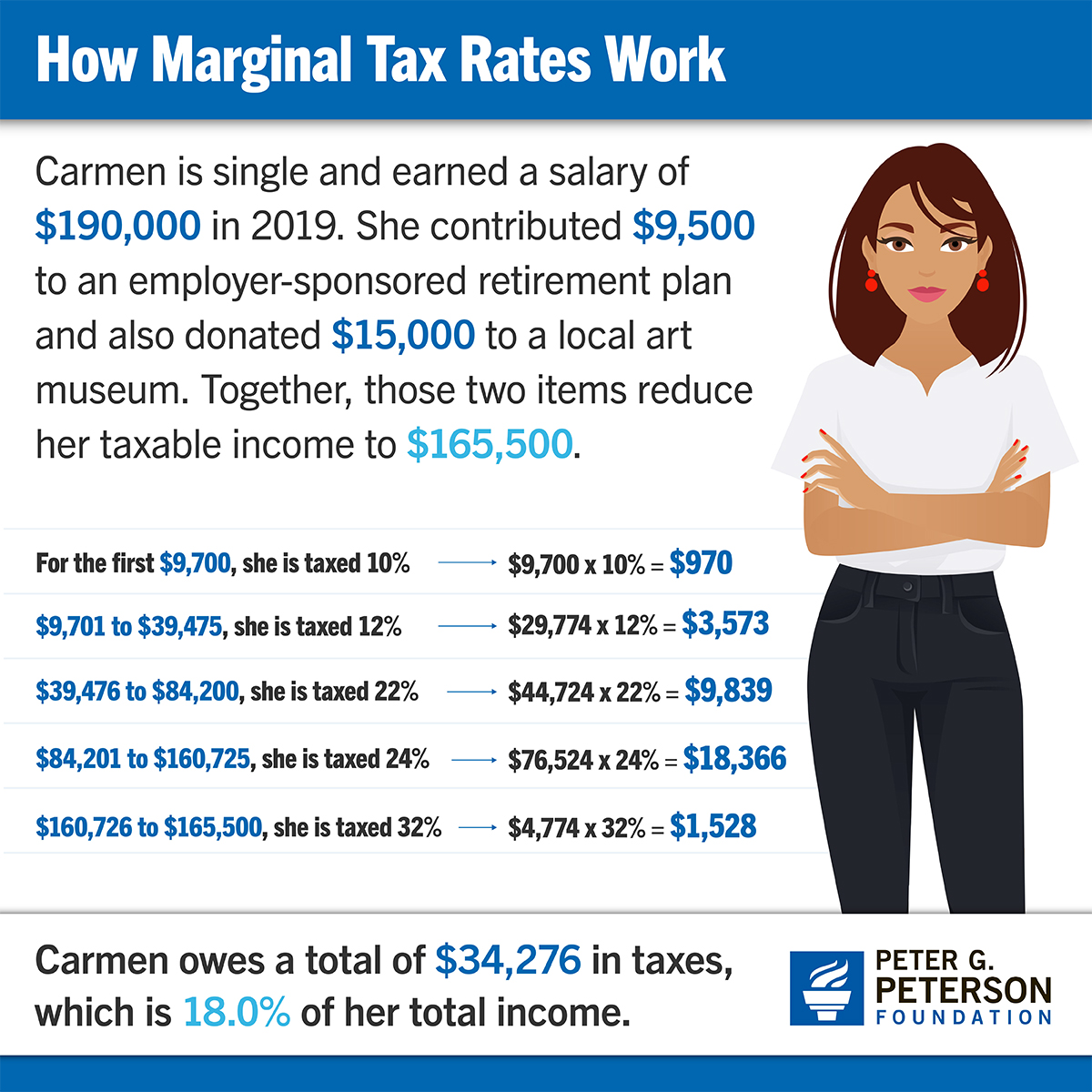

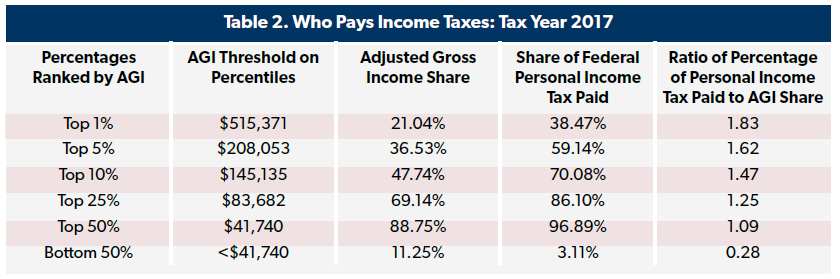

The discount can be a single. For the complete rundown, go to irs publication 502. 1) pay 100 percent of your tax liability from last year, or 110 percent if you're adjusted gross income is $150,000 or more and you're submitting your tax return as married.

If you haven't maxed out for the. Your tax code indicates how much tax hmrc will collect from your salary. Some penalty relief requests may be accepted over the phone.

There are also different ways to cut taxes. If you do not get hra but pay rent, you can claim a deduction under section 80gg up to rs 60,000 per annum. Second, you don’t have to pay taxes on any investment returns in the account.

Start by entering your basic details, including your occupation. Stash money in your 401 (k) 3. The government can reduce income, profit, sales or property taxes.

20.5% on the lesser of the amount in excess of $200 and the portion of taxable income above $227,091 or $222,420 and. Donate to charity as long as you donate money to a registered charity, you can claim a deduction on your taxes for the amount you give away. After you make the decision to become financially independent i think it is very important to learn the basics of the tax system, learn how taxes are calcula.

Even if you don’t have the budget to save nearly. The mission of tbr is to achieve a significant reduction in unnecessary burden for all taxpayers. Add an extra $6,500 if you’re 50 or older for a total of $27,000.

Charitable and other gifts lowest tax rate on first $200. And third, as long as you use the. 5) get a deduction on the interest on your home loan.

/dotdash_Final_Net_of_Tax_Dec_2020-98efd407350341fdb178949dadd84c5c.jpg)