Divine Tips About How To Reduce Taxes On Your Social Security Benefits

Most retirees are looking to pull money from their iras rather than put it.

How to reduce taxes on your social security benefits. How to minimize taxes on your social security 1. Manage your other retirement income sources. Withdrawals from a traditional ira are included in income and fully taxable.

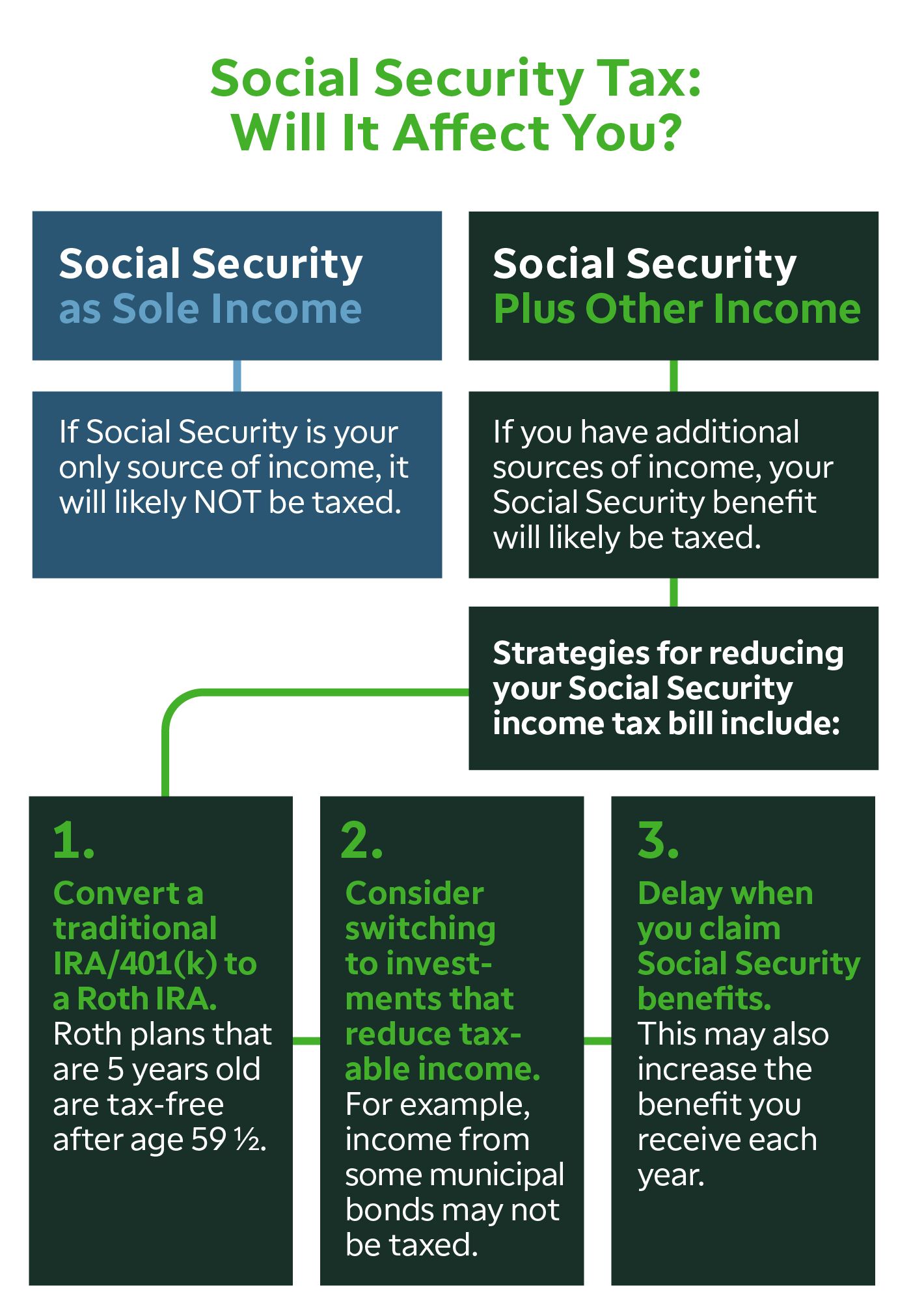

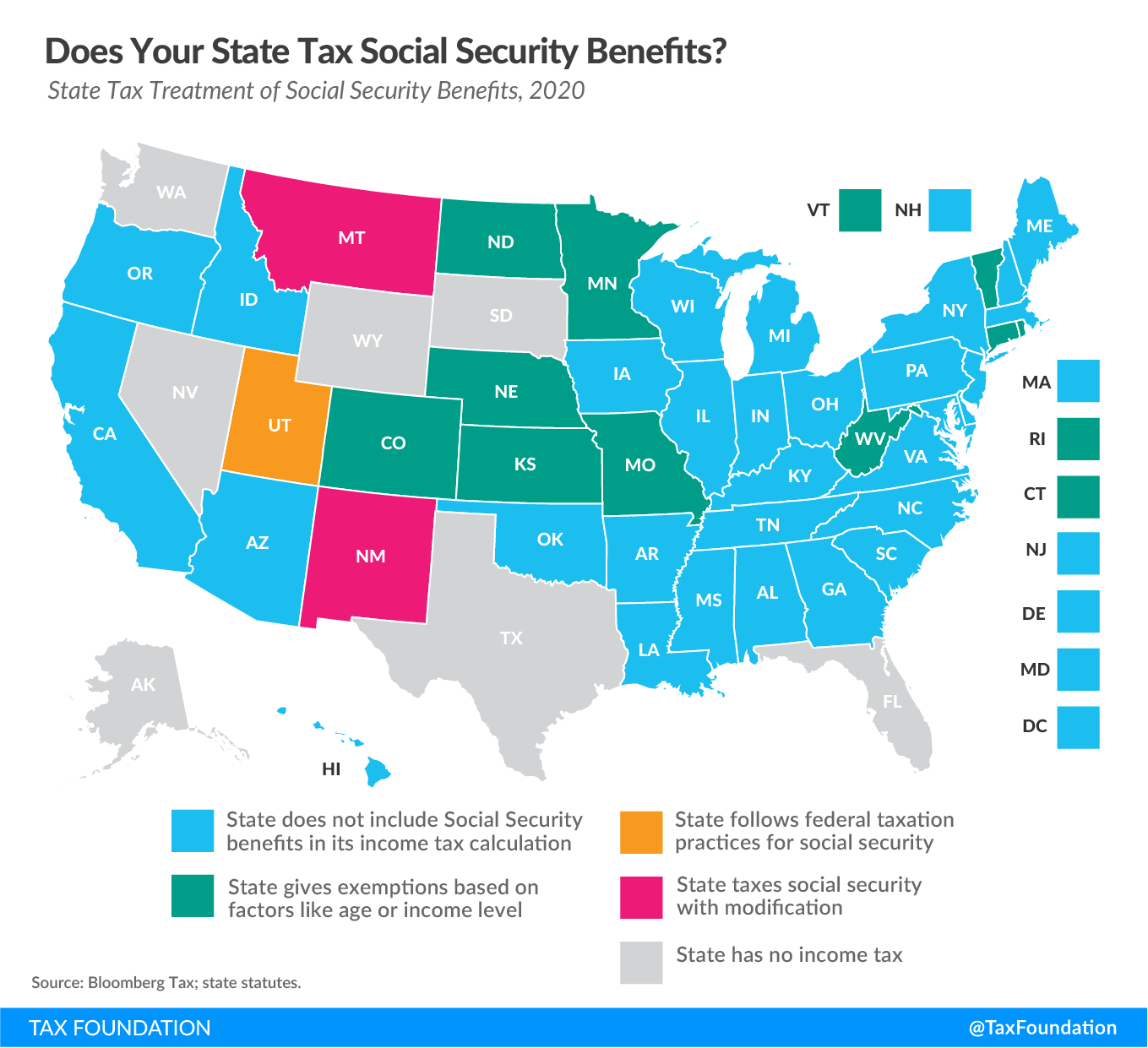

These thresholds are higher for married couples filing jointly. But you can take steps to minimize. How to reduce or eliminate taxes on social security benefits!

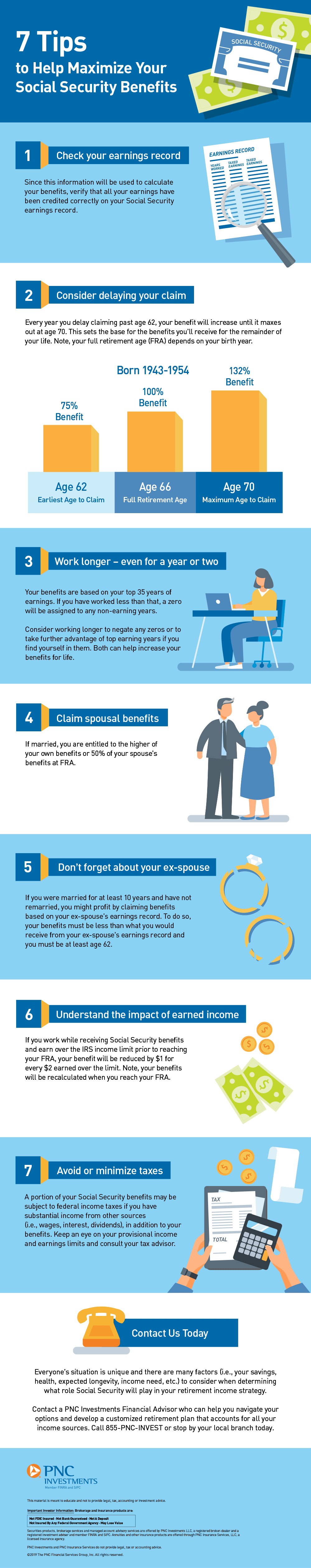

See these tips on how to reduce those potential taxes. We use the following earnings limits to reduce your benefits: How can i have income taxes withheld from my social security benefits?

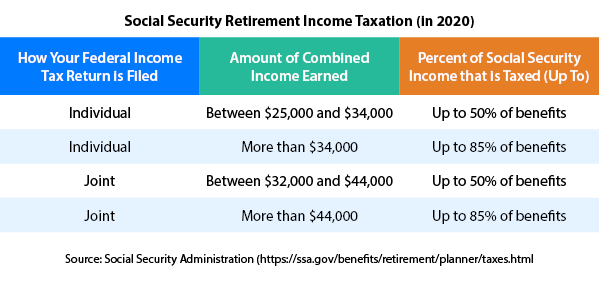

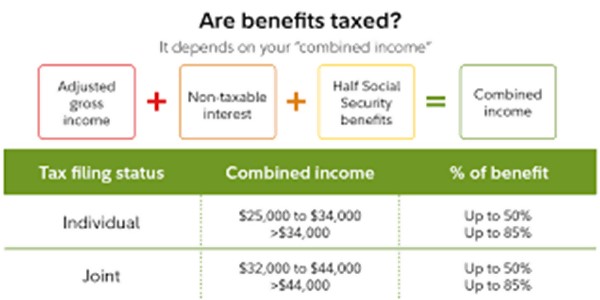

3 ways to avoid taxes on benefits place some retirement income in roth accounts. Don’t let your rental income reduce your social security benefits the retirement earnings test is only used to determine social security’s income cutoff for employment. (how to minimize taxes in retirement) up to 85% of your social security benefits can be subject.

One way to lower your tax bill is to opt for a qualified charitable distribution, or qcd, which lets you give your required minimum distributions to charity. Rolling over money from a traditional ira or 401 (k) to a roth years before you start receiving social security benefits is a good way to avoid taxes later in retirement. Here's how to reduce or avoid taxes on your social security benefit:

(if you are deaf or hard of hearing, call the irs tty number, 1. If you are under full retirement age for the entire year, we deduct $1 from your benefit payments for every $2 you. This strategy beats paying taxes on your income once you’ve retired and don’t have that much money to spare.

As much as 85% of. Social security benefits — yours, your parents or an elderly relative's, let's say — can be subject to income tax. Ways to reduce or eliminate social security tax first, let's address the roth ira.

7 once you reach full. Stay below the taxable thresholds. If you earn more than $50,520 ($51,960 for 2022) it deducts $1 for every $3 you earn—but only during the months before you reach full retirement age.

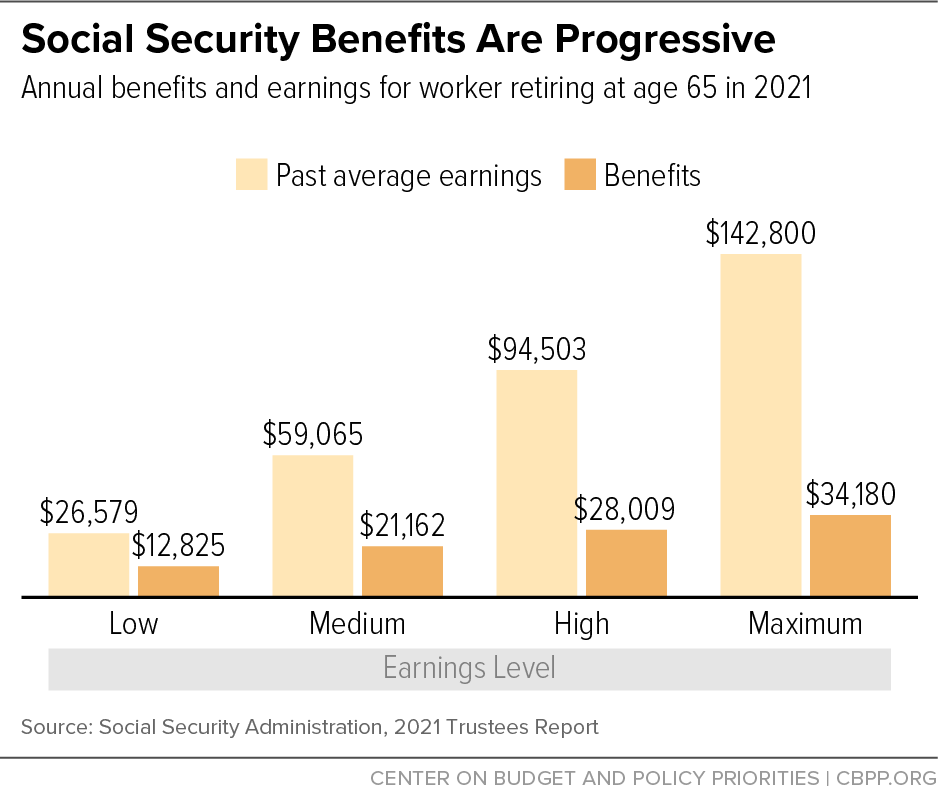

To determine the percentage that. The broad overview of taxes on social security is that somewhere between 0% and 85% of your benefit payments could be counted as taxable income. As you can see from the formula, the main ways to reduce your combined income would be to reduce your nontaxable interest or reduce your agi.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

/GettyImages-1134937342-4f983d6e2462466b902206a0525d82b3.jpg)