Unbelievable Info About How To Sell Calls

First, it is essential to understand that there are two ways to sell a call option, by writing a new contract, or by selling a call option you already own.

How to sell calls. You can sell enough contracts to cover your entire underlying position. Then, select the correct strike. You sell a call option with a strike price near your.

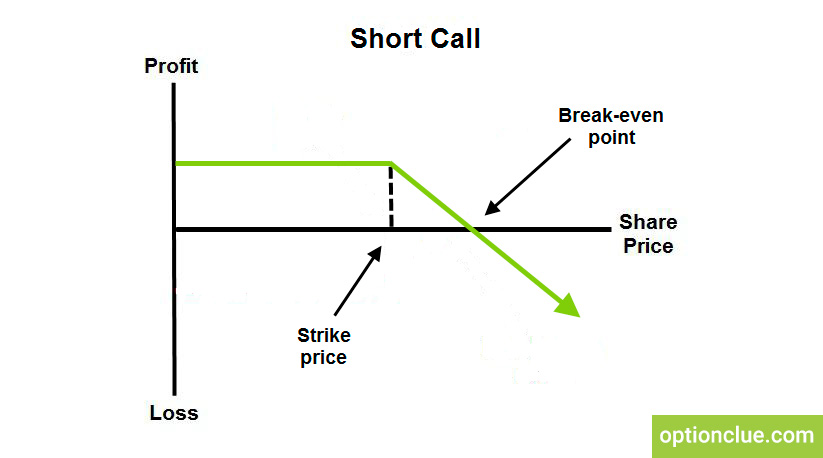

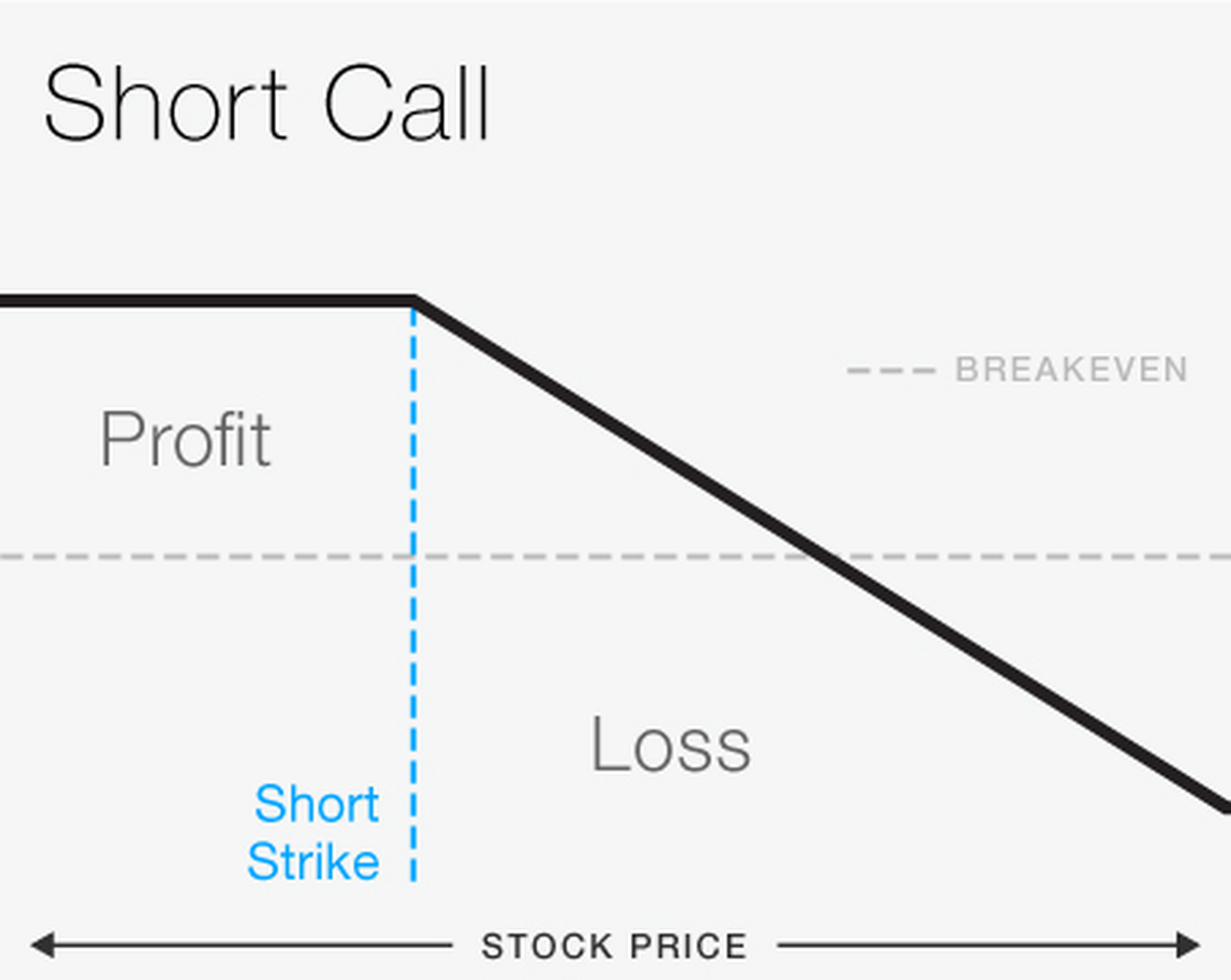

A short call is a strategy involving a call option, giving a trader the right, but not the obligation, to sell a security. 59 minutes agodalke attempted to sell these in exchange for money to someone he thought was linked to a foreign government. You determine the price at which you’d be willing to sell your stock.

How to sell covered calls the investor has (or buys) 100 shares of a stock. Find the stock you’d like to sell a call option for. Frequently asked questions about how to sell covered calls.

Selling options involves covered and uncovered strategies. If you’re trading options, you’re. In my example, i own 100 shares of aapl and will be selling a covered call with a.

To do so, tap the magnifying glass in the top right corner of your. The key to success in covered call strategies is to pick the right company to sell the option on. Open the robinhood app and enter your credentials to sign in.

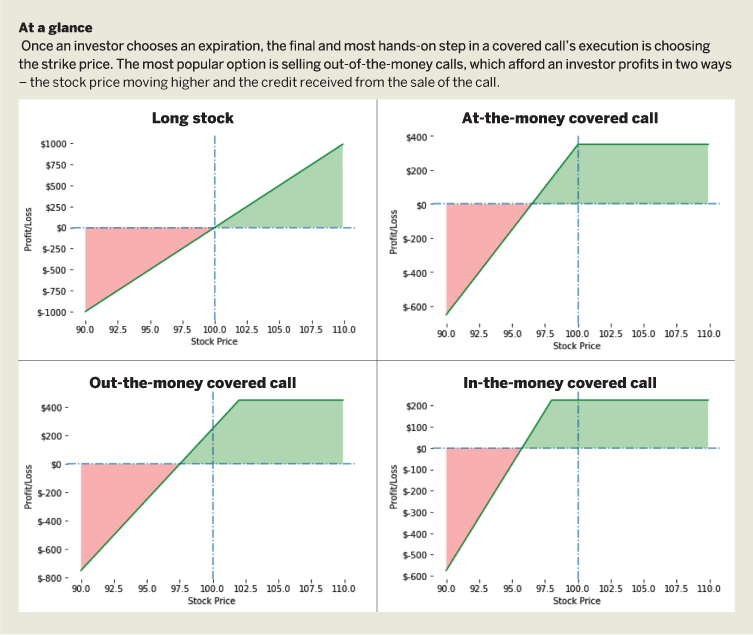

The intent of a covered call strategy is to generate income on an owned stock, which the seller expects will not rise significantly during the life of the options contract. Talk to the person, not the product. A covered call, for instance, involves selling call options on a stock that is already owned.

They don’t care if you’re on the national do not call registry. In fact, the buyer turned out to be an fbi online covert. Selling covered calls is a strategy in which an investor writes a call.

This part is the same no matter. They make money by pocketing the premiums (price). You sell a call option consisting of the right to purchase 100 shares of a stock before the expiration date of the contract for a set price.

If you're planning on selling sales lead calls, you essentially have two options. The investor selects a call option that represents those shares at a desired strike price and. Before you make the call, determine your prospect’s needs and pain points.

To sell a call means you give someone else the right but not the obligation to buy the contract from you at a certain price within a certain date. Call option sellers, also known as writers, sell call options with the hope that they become worthless at the expiry date. Puts but what exactly happens when you sell a call option?

:max_bytes(150000):strip_icc()/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

![How To Sell A Call Option - [Option Trading Basics] - Youtube](https://i.ytimg.com/vi/SAgkEWTGTDw/maxresdefault.jpg)

/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)

![How To Sell A Call Option - [Option Trading Basics] - Tradersfly](https://tradersfly.com/wp-content/uploads/2019/06/2017-07-27-selling-call-options-single-296.jpg)

:max_bytes(150000):strip_icc()/NakedCallWriting-AHighRiskOptionsStrategy2_2-aab223af50cc44ba9a0f874609356225.png)

:max_bytes(150000):strip_icc()/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)